Latest Blogs

Mold Growth After Water Damage: Strategies for Prevention and Remediation

Water damage can be caused by a variety of factors not limited to burst pipes, severe rainstorms, and floods. When it occurs, you’re left to deal with water damage restoration, as well as mold remediation services. Mold remediation is necessary because mold spores can develop in as little as 24 hours after water damage. Worse […]

Learn MoreEmergency Response: How Residential Damage Restoration Services Can Save Your Home

Here’s the thing about emergencies: they always catch you off guard. Despite your best efforts to be prepared, unforeseen events like storms and accidents are beyond our control. That is why knowing who to call for quality residential restoration services matters. Knowing how to treat the most common forms of residential damage, like mold infestations […]

Learn MoreFire Safety in the Winter Months

Decorating homes and businesses for the holidays, as well as keeping properties heated can cause devastating damage. Property owners can turn to BluSky when fire strikes. Follow these tips and guidelines for home and workplace fire safety. During the Holidays: – Use outside lights outside, and inside lights inside – Plug lights directly into an […]

Learn MoreWinter Weather & Freezing Temps: Tips to Avoid Damage

How to prevent pipes from freezing and what to do if they do freeze This time of year, with the winter temperatures coming across much of the country, it is so important to protect your home or property from such elements as ice, snow, and wind. BluSky recommends several ways to prevent pipes from freezing […]

Learn MoreCareers in Construction Month

With October wrapping up, we wanted to reflect on Careers in Construction Month here at BluSky. Careers in Construction Month is a month-long celebration of the various career paths in building trades industry. This national campaign aims to increase public awareness of construction careers and inspire the next generation of craft professionals and make an impact […]

Learn MoreCatch BluSky Restoration Subject Matter Experts at the RIA Virtual Fall Technical Conference

The Fall Technical Conference agenda was built around the theme of “Creating Efficient Teams through the Use of Technology”. BluSky team members Jon Vogt and John Warnick will be presenting on 3D Technology: How It Can Impact the Breadth of Your Business. Using 3D Technology is proven to save time and money with the bonus […]

Learn MoreBenefits of Managed Repair Programs for Property Insurance Claims

Written by: Chris Sechrest, VP of Managed Repair Programs If you’ve ever filed a property insurance claim, you know that the process can be long and complicated. One way to streamline the process and ensure that your repairs are done correctly is to use a managed repair program. A managed repair program is a partnership […]

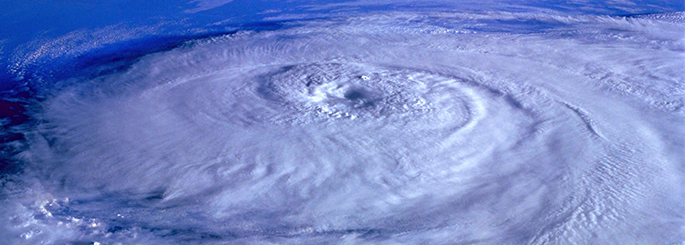

Learn More5 Tips to Get You Ready for a Hurricane

Hurricanes are dangerous and can cause major damage from storm surge, wind damage, rip currents and flooding. They can happen along any U.S. coast or in any territory in the Atlantic or Pacific oceans. Storm surge historically is the leading cause of hurricane-related deaths in the United States. Don’t get caught unprepared. The Eastern Pacific […]

Learn MoreMold 101

Written by: Agustin Rodriguez, Vice President: Environmental Services BluSky’s Environmental Services division manages hundreds of hazardous environmental remediation projects annually, including mold remediation, asbestos abatement, and other biohazard cleanup for commercial properties. What is Mold? Mold is a fungal growth that forms and spreads on various kinds of damp or decaying organic matter. There are […]

Learn MoreThe Real Deal in Raleigh

Every office has one or two of these – those cultural cheerleaders who consistently make a positive impact and spread those feel-good vibes the moment they walk into a room. They are respected and trusted colleagues, value and appreciate everyone on their team, are caring and supportive, and thrive on celebrating workplace culture. Just as […]

Learn MoreNational Safety Stand-Down

At BluSky, safety is our number one priority. Our employees pledge to structure the worksite to be as safe as possible and to communicate potential health & safety hazards preventing accidents, injuries, and illness on BluSky jobs. Safety management works to provide employees with the best and latest in training and resources to keep themselves […]

Learn MoreWhat to do before, during, and after a hurricane

You can be prepared for potential hurricane conditions by following these tips from BluSky.

Learn MoreTips to Prevent Long-Term Water Damage

Water-Related Disasters Require Fast Action Water is one of the most destructive elements to property, buildings and their inhabitants. Damage becomes more severe with unsanitary water and when cleanup and dry-out services are delayed. There are three categories of water to be aware of, and here’s what to do when you encounter them: Category 1: […]

Learn MoreChuck Lane Reflects on Learning & Development

Training has always been my passion. I believe a career journey requires a combination of skill sets, mindset, and willingness to take risks. In my case, it started with finding my passion. I never had the luxury of being one of those people who knew they wanted to be in a certain role. I just […]

Learn MoreBluSky Hidden Heroes: Women in Construction!

Written by: Jenna Martin, BluSky Restoration Contractors Gone are the days you would only see a group of men at the jobsite. It’s no secret construction is one of the most male-dominated professions in the world – and while women are certainly underrepresented in the trades, women are joining the industry in numbers higher than […]

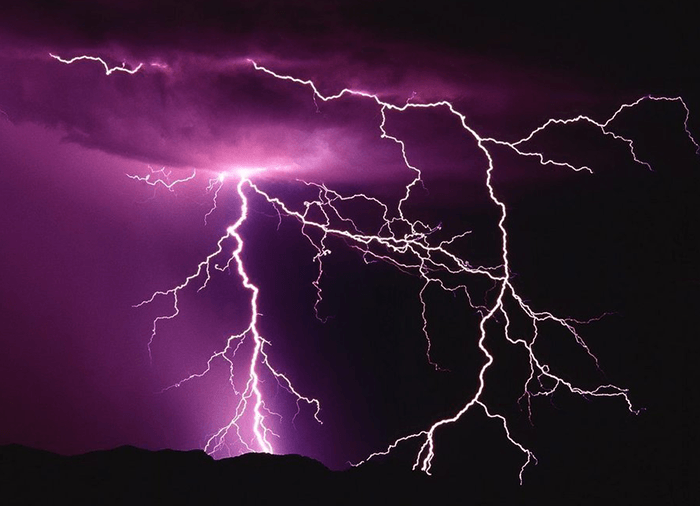

Learn MoreBe Safe in Severe Summer Weather

Summer is the peak season for lightning strikes in North America, but a little caution and common sense can help you stay safe year-round. While lightning doesn’t have an off-season, the National Weather Service focuses its safety efforts in summer because that’s when problems tend to surge. Warm weather not only helps spawn thunderstorms, but […]

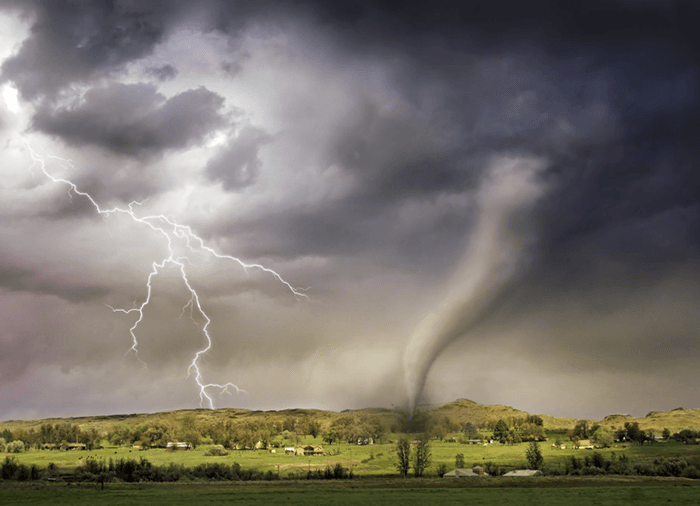

Learn MoreTornado Season – Be Prepared

Tornadoes are violent by nature. They are capable of completely destroying well-made structures, uprooting trees and hurling objects through the air like deadly missiles. A tornado is a violently rotating column of air extending from the base of a thunderstorm down to the ground. Tornado intensities are classified on the Fujita Scale with ratings between […]

Learn MoreWater Problems? It’s As Easy As 1, 2, 3…

Did you know there are 3 types of water losses? When you call someone in to take care of water that’s overflowed, leaked or seeped in, you can help your insurance company and contractors along by letting them know what type of water issue you are having so they can be prepared with the proper […]

Learn MoreWinter Water Damage

This time of year with the polar-vortex-type temperatures we are experiencing in the Chicagoland area, it is so important to protect your home or property from such elements as ice, snow, and wind. How to Manage a Burst Pipe Until Restoration Specialists Arrive If you experience a water damage event from a frozen/burst pipe, make […]

Learn MoreMold in Your House: How to Banish and Prevent the Gross Green Growth

{Repost from VIPHomeLink.com} We’re all in favor of “going green,” but when it comes to mold, you definitely want to prevent green from taking over your home. That’s why we reached out to Bill Titus, who has been specializing in mold remediation for more than four years. Bill helps between 100 and 200 homeowners each […]

Learn More